Fiscal Affairs (3)

{modal href="/images/Organogram/MoFDP Chart_Fiscal-Affairs.png" alt="MoFDP Chart_Fiscal-Affairs" rel="{handler:'iframe',size:{x:1100,y:600}}"} {/modal}

{/modal}

Samora P. Z. Wolokolie, MBA, CFE, CA, CPA, CFIP

Over the course of a professional career in business and finance spanning 14+ years, Samora P.Z. Wolokolie has lived and worked in Liberia; serves as Deputy Minister for Fiscal Affairs at the Ministry of Finance and Development Planning. His primary responsibility is to manage the financial resources of Liberia; develop and administer the financial rules and regulations of the republic. He oversees and executes all matters relating to government accounting, including pay, pensions, and other allowances as well as develop fiscal policy. Additionally, he is responsible to oversee all matters concerning the framing of proposals regarding tax and non-tax revenue, tax reform as part of fiscal consolidation, coordinate with and generally perform all such services relative to the management of government finances as may be required by law; and implement expenditure proposals of Ministries and Agencies of Government as appropriated in the budget. Immediately prior to his appointment as Deputy Minister for Fiscal Affairs at the Ministry of Finance and Development Planning by His Excellency Dr. George Manneh Weah, Hon. Wolokolie served as Managing Partner of a BICON. INC. national firm; his professional experience includes a period of service with Baker Tilly, Liberia (then VOSCON INC) and PKF, Liberia at senior management levels (Before joining BICON, Inc.), Mr. Wolokolie is a recognized, professional accountant, auditor and tax practitioner in Liberia and has served as Engagement Manager in-charge of Audit and Tax with as well as Audit Supervisor at Baker Tilly, Liberia (then VOSCON, INC) and PKF, Liberia respectively in Monrovia. He also served as Director of the Internal Audit Division at the Ministry of Finance under a definite World Bank / GOL contract. Mr. Wolokolie is an adjunct lecturer of Auditing, Taxation and Accounting at the Arthur Barclay Business College of the Stella Maris Polytechnic and the Financial Management Training Program (FMTP), graduate school, of the University of Liberia and financed by the Ministry of Finance and Development Planning through a World Bank-funded project. He has spoken at various professional gatherings and forums in several workshops and seminars in and out of Liberia.

Samora is a multi-skilled, business consultant. His successful track record as a high-level consulting and risk management, tax and audit practitioner in competitive national and international markets has required, a willingness to appreciate, learn and successfully employ skills in a number of key multi-disciplinary areas. Samora’s skill sets and prior experience include:

- Business evaluation and Corporate Strategy

- Corporate Governance, Risk Management, and Internal Audit

- Process Mapping and the Design / Implementation of Control Systems

- Financial Management

- Corporate Financial and Regulatory Reporting

- Audit and Assurance (External and Internal)

- Project Management, training, and Human Resource Management

Samora is a Liberian scholar and holds an MBA in Accounting from the Cuttington University in 2007. He is a Chartered Accountant (CA) of the Institute of Chartered Accountants (Ghana), a Certified Public Accountant (CPA) of the Liberian Institute of Certified Public Accountant, a Certified Fraud Examiner (CFE) of the Association of Certified Fraud Examiner, USA and Certified Forensic Investigation Professional (CFIP) of the International Institute of Certified Forensic Investigation Professional of Kenya and USA. Additionally, he holds membership with the Liberian Institute of Certified Public Accountants (LICPA), the Institute of Chartered Accountants of Ghana (ICAG), Association of Certified Fraud Examiner (ACFE), Institute of Internal Auditors (IIA) and International Institute of Certified Forensic Investigation Professionals (IICFIP). His ability to blend his core technical expertise, broad managerial competencies and varied work-experiences with his relationship-building (interpersonal) and leadership skills, has underpinned his professional and career successes over the last one and a half decade.

Samora managed audits of USAID contractors receiving contracts and grants for capacity building projects in Liberia. The objectives of the audits were to determine that: charges to contracts and grants were properly supported and reasonable, internal control structure was adequate, overhead costs were allocated in compliance with contract provisions and applicable laws and regulations. The audits were performed in accordance with generally accepted auditing standards, Government Auditing Standards, and provisions of the Federal Acquisition Regulations.

Mr. Wolokolie has overseen large, multi-site audit and consulting engagements for entities with complex organizational structures and accounting systems. Mr. Wolokolie prepared numerous management letters recommending improvements in the internal controls for a wide variety of accounting systems in both the public and private sectors. Additionally, he managed the implementation of system improvements such as the standardization of accounting procedures among related entities.

As an audit partner, Mr. Wolokolie had substantial experience in all phases of the audit cycle. He participates in the planning of audits and reviews; discusses audit progress (including all significant issues) with the audit manager or in-charge accountant; and provides technical expertise when difficult audit matters arise. He performs primary and overriding reviews of the working papers and client reports.

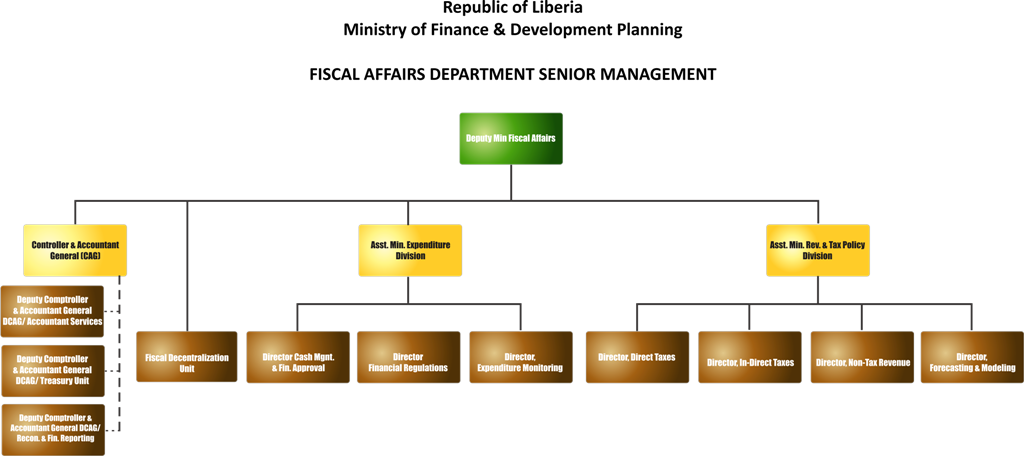

This Department is responsible for all fiscal matters relating to Expenditure and Revenue as well as Tax Policy. With the establishment of a semi-autonomous Revenue Authority, the Department of Fiscal Affairs deals with revenue and tax policy issues, including framing of tax laws and regulations, role of taxation and tax exemptions in the broader economic and development policy framework, and issues relating to non-tax revenue.

In addition to revenue and tax issues, Fiscal Affairs further deals with public expenditure issues ranging from framing of financial rules and regulations to matters pertaining to government accounting. The Department has oversight of the Controller and Accountant General Office, the Integrated Financial Management Information System (IFMIS), policies on government subsidies, pay, allowances, pension policies and monitoring of public expenditure.

The Department of Fiscal Affairs comprises the divisions of Expenditure and Revenue and Tax Policy.

Expenditure Division

The Expenditure Division, headed by an Assistant Minister, manages the financial resources of Liberia. The Division is responsible to develop and administer the financial rules and regulations of the Republic; oversee and execute all matters relating to government accounting, including pay, pensions and other allowances, as well as develop fiscal policy. In addition, the Expenditure Division also implements expenditure proposals of Ministries and Agencies of Government as appropriated in the Budget, and performs other functions as may be assigned by the Minister as well as imposed by law.

Revenue and Tax Policy Division

The Revenue and Tax Policy Division, headed by an Assistant Minister, is primarily a policy division that addresses tax and non-tax revenue policies. This Division and the Ministry will interface with the Liberia Revenue Authority (LRA), a semi-autonomous agency, under the general supervision and direction of the Minister, responsible for implementing the tax laws and collecting taxes. The Tax Policy Division has responsibility for forecasting revenue and providing the forecasts to the Budget Division in the Department of Budget and Development Planning, as well as the Macroeconomic Policy Division in the Department of Economic Management.

Main Functions of the Revenue & Tax Policy Division:

• Development and implementation of tax policy proposals, drafting legislation, regulations, procedures and published guidance, participation in negotiation of mining, petroleum and other concession agreements;

• Provide receipts and revenue forecast, including estimates for cash management and type of tax for the Budget, revenue estimates for actual and proposed legislation;

• Perform economic modeling, including development and maintenance of data bases for tax analysis, development of models for tax analysis, including micro simulation models and income distribution effects of current and proposed laws;

• Development of international tax policy, such as negotiation of tax treaties and tax harmonization within ECOWAS;

• Perform other functions, including responding to questions from Parliament; coordinating with macro-economic and budget receipts offices of the MFDP;

• Work closely with the LRA on a number of functions, on which LRA will lead in most cases, including:

o Development of tax policy proposals to improve and simplify tax compliance and tax administration and analysis of the compliance and tax administration implications of legislative proposals;

o Development and publication of an annual tax expenditure budget, measurement of compliance gaps and publication of tax statistics;

o Meeting the Government’s obligations under the Liberia Extractive Industry Transparency Initiative (LEITI).

Location

P. O. Box 10 - 9016

Broad & Mechlin Street

1000 Monrovia

info@mfdp.gov.lr